3rd Italian Workshop of Econometrics and Empirical

Economics High-dimensional and Multivariate Econometrics: Theory and Practice

Rimini Campus - University of Bologna

20-21 January 2022

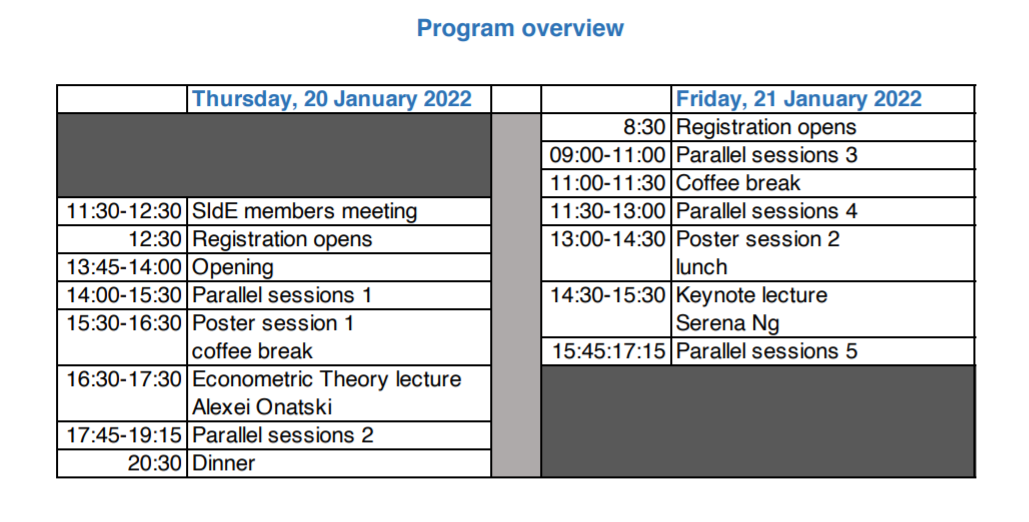

**Thursday, 20 January 2022

11.30-12.30 SIdE members meeting

12.30 Registration opens

13.45-14.00 Opening Monica Billio (SIdE president), Luca Fanelli (chair of organizing committee) ROOM ALBERTI 7

14.00- 15.30 : Parallel sessions – 1

Parallel 1-A – Energy – sponsored by SGR (chair: Francesco Ravazzolo) ROOM ALBERTI 7

- When Do Investors Go Green? Evidence from a Time-varying Asset-pricing Model - Lucia Alessi, Elisa Ossola, Roberto Panzica ONLINE

- Forecasting Commodity Prices in a Data-rich Unstable Environment - Anastasia Allayioti, Fabrizio Venditti ONLINE

- Short-Term Hydropower Optimization Driven by Innovative Time-adapting Econometric Model - Diego Avesani, Ariele Zanfei, Nicola Di Marco, Andrea Galletti, Francesco Ravazzolo, Maurizio Righetti, Bruno Majone

Parallel 1-B – Networks 1 (chair: Camilla Mastromarco) ROOM ALBERTI 8

- FNETS: Factor-adjusted Network Estimation and Forecasting for High-dimensional Time Series - Matteo Barigozzi, Haeran Cho, Dom Owens ONLINE

- Learning Financial Network with Focally Sparse Structure - Victor Chernozhukov, Chen Huang, Weining Wang ONLINE

- Efficiency Networks in EU: An Heterogeneous Spatial Autoregressive Frontier Model - Camilla Mastromarco, Laura Serlenga, Yongcheol Shin

Parallel 1-C – Econometric theory 1 (chair: Giuseppe Cavaliere) ROOM ALBERTI 9

- Testing Many Restrictions Under Heteroskedasticity - Stanislav Anatolyev, Mikkel Sølvsten

- Inference in a Spatial Autoregressive Model with an Extended Coefficient Range and a Similarity-based Weight Matrix - Francesca Rossi, Offer Lieberman ONLINE

- Bootstrap Inference in the Presence of Asymptotic Bias - Giuseppe Cavaliere, Sílvia Gonçalves, Morten Ørregaard Nielsen ONLINE

15:30-16.30 Poster session 1 ONLINE - coffee break ROOM ANGHERA’ 3

16.30-17.30 Econometric Theory lecture (chair: Matteo Barigozzi) ROOM ALBERTI 7

Alexei Onatski

Uniform Asymptotics for Strong and Weak Factors

17:45-19.15 Parallel session 2

Parallel 2-A – Networks 2 (chair: Michele Costola) ROOM ALBERTI 7

- Identifying Dominant Units Using Graphical Models in Panel Time Series Data - Jan Ditzen, Francesco Ravazzolo ONLINE

- A Dynamic Stochastic Block Model for Multi-Layer Networks - Ovielt Baltodano Lopeź, Roberto Casarin

- Matrix-variate Smooth Transition Models for Temporal Networks - Monica Billio, Roberto Casarin, Michele Costola, Matteo Iacopini ONLINE

Parallel 2-B – Vector Autoregressions (chair: Lorenzo Mori) ROOM ALBERTI 8

- Partially Identified Heteroskedastic SVARs: Identification and Inference - Emanuele Bacchiocchi, Andrea Bastianin, Toru Kitagawa, Elisabetta Mirto

- State-dependent Impulse Response Functions: Identification and Estimation - Sílvia Gonçalves, Ana María Herrera, Lutz Kilian, Elena Pesavento ONLINE

- Uncertainty, Skewness, and the Business Cycle Through the MIDAS Lens - Efrem Castelnuovo, Lorenzo Mori

Parallel 2-C – Financial econometrics (chair: Jean-Michel Zakoïan) ROOM ALBERTI 9

- Estimating Financial Networks by Realized Interdependencies: A Restricted Vector Autoregressive Approach - Massimiliano Caporin, Deniz Erdemlioglu, Stefano Nasini

- Financial Stability in Europe Under Climate Transition Distress. A Scenario-based Systemic Risk Approach - Javier Ojea-Ferreiro, Juan C. Reboredo, Andrea Ugolini ONLINE

- Estimating conditional systemic risk measures in semi-parametric volatility models - Loïc Cantin, Christian Francq, Jean-Michel Zakoïan

20:30 Social Dinner at Quartopiano Suite Restaurant

** Friday, 21 January 2022

9.00- 11.00 Parallel session 3

Parallel 3-A – Non-linear time series (chair: Emanuele Bacchiocchi) ROOM ALBERTI 7

- Identification of Nonlinear Time Series Models with Additive Noise - Francesco Cordoni, Nicolas Doremus, Alessio Moneta

- Why Does Risk Matter More in Recessions than in Expansions?

Martin Andreasen, Giovanni Caggiano, Efrem Castelnuovo, Giovanni Pellegrino ONLINE - Monetary Policy Shocks over the Business Cycle: Extending the Smooth Transition Framework - Martin Bruns, Michele Piffer

- SVARs with Breaks: Identification and Inference - Emanuele Bacchiocchi, Toru Kitagawa

Parallel 3-B – Filtering (chair: Alessandro Giovannelli) ROOM ALBERTI 8

- Three States of the French Business Cycle - Catherine Doz, Anna Petronevich ONLINE

- GDP Solera. The Ideal Vintage Mix - Martín Almuzara, Dante Amengual, Gabriele Fiorentini, Enrique Sentana

- Using Industry-Level Data to Estimate the U.S. Output Gap - Gianni Amisano, Philip Coyle, Manuel González-Astudillo ONLINE

- Band-Pass Filtering in the Time Domain: Empirical Evidence on U.S. GDP - Alessandro Giovannelli, Marco Lippi, Tommaso Proietti ONLINE

Parallel 3-C – Statistical learning in microeconomics (chair: Silvia Sarpietro) ROOM ALBERTI 9

- Policy Evaluation of Waste Pricing Programs Using Heterogeneous Causal Effect Estimation - Marica Valente

- A Generalised ROC Curve - Paolo Giudici, Emanuela Raffinetti ONLINE

- Trends in the U.S. Gender Wage Gap: 1977–2019 - Vidhi Gandotra, Andrew Komendantov, Andrea Medici, Karan Patel, Franco Peracchi ONLINE

- Individual Forecast Selection - Raffaella Giacomini, Sokbae Lee, Silvia Sarpietro

11.00-11.30 Coffee break ROOM ANGHERA’ 3

11.30-13.00 Parallel session 4

Parallel 4-A – Factor models (chair: Gianluca Cubadda) ROOM ALBERTI 7

- Dynamic Factor Models: Does the Specification Matter? - Karen Miranda, Pilar Poncela, Esther Ruiz

- The Main Cycle Shock(s), Frequency-Band Estimation of the Number of Dynamic Factors - Marco Avarucci, Maddalena Cavicchioli, Mario Forni, Paolo Zaffaroni ONLINE

- Dimension Reduction for High Dimensional Vector Autoregressive Models - Gianluca Cubadda, Alain Hecq ONLINE

Parallel 4-B – Econometric theory 2 (chair: Alessandra Luati) ROOM ALBERTI 8

- Bootstrap Inference for Hawkes and General Point Processes - Giuseppe Cavaliere, Ye Lu, Anders Rahbek, Jacob Stærk-Østergaard ONLINE

- Autoregressive Conditional Betas - Francisco Blasques, Christian Francq, Sebastień Laurent

- Dynamic Multiple Quantile Models - Leopoldo Catania, Alessandra Luati, Emil Bach Mikkelsen

Parallel 4-C – Unit roots (chair: Paolo Paruolo) ROOM ALBERTI 9

- Generic Identifiability for REMIS: The Unit Root VAR-Case - Philipp Gersing, Leopold Sögner, Manfred Deistler ONLINE

- High-dimensional Threshold Regression with Common Stochastic Trends - Daniele Massacci, Lorenzo Trapani ONLINE

- Cointegration, Root Functions and Minimal Bases - Massimo Franchi, Paolo Paruolo ONLINE

13.00-14.30 Poster session 2 - lunch ROOM ANGHERA’ 3

14.30- 15.30 Keynote lecture (chair: Giuseppe Cavaliere) ROOM ALBERTI 7

Serena Ng - Richard Davis ONLINE

Time Series Estimation of the Dynamic Effects of Disaster Type Shocks

15.45-17.15 Parallel session 5

Parallel 5-A – Econometric theory 3 (chair: Mario Mattioli) ROOM ALBERTI 7

- Performance of Empirical Risk Minimization for Linear Regression with Dependent Data - Christian Brownlees, Guðmundur Stefań Guðmundsson ONLINE

- A Multivariate ARCH(∞) Model with Exogenous Variables and Dynamic Conditional Betas Christian Francq, Julien Royer, Jean-Michel Zakoïan

- Circumventing Violations of Stochastic Equicontinuity in M-estimation - Mario Martinoli, Fulvio Corsi, Raffaello Seri

Parallel 5-B – Macroeconometrics (chair: Antonio Conti) ROOM ALBERTI 8

- How Does Monetary Policy Affect Income and Wealth Inequality? Evidence from Quantitative Easing in the Euro Area - Michele Lenza, Jiri Slacalek ONLINE

- Fiscal Limits and the Pricing of Eurobonds - Kevin Pallara, Jean-Paul Renne ONLINE

- The Wage-employment Nexus: A Tale of Persistence - Antonio Conti, Elisa Guglielminetti, Marianna Riggi ONLINE

Parallel 5-C – Bayesian inference (chair: Matteo Iacopini) ROOM ALBERTI 9

- Score-Driven Generalized Poisson Model - Giulia Carallo, Roberto Casarin, Dario Palumbo ONLINE

- MCMC Conditional Maximum Likelihood for the Two-way Fixed-effects Logit - Francesco Bartolucci, Claudia Pigini, Francesco Valentini

- Bayesian Semiparametric Estimation of Structural VAR Models with Stochastic Volatility - Matteo Iacopini, Luca Rossini

** Poster sessions

Poster session 1 ONLINE

A Multivariate Extension of the Misspecification Resistant Information Criterion - Gery Andreś Díaz Rubio, Simone Giannerini, Greta Goracci

Investor Sentiment and Global Economic Conditions Miguel C. Herculano, Eva Lütkebohmert

Demand or Supply? An Empirical Exploration of the Effects of Climate Change on the Macroeconomy - Matteo Ciccarelli, Fulvia Marotta

Costly Independence? The Unintended Effects of the ECB’s Government Bond Purchases - Armando Marozzi

Hierarchical Bayesian Fuzzy Clustering Approach for High Dimensional Linear Time-Series - Antonio Pacifico

Modelling and Extracting the Term Structure of Interest Rates: A Unifying Framework - Dario Palumbo

Poster session 2 in presence ROOM ANGHERA’ 3

Identification of Non-Rational Risk Shocks - Maximilan Böck

Is Global Warming (Time) Reversible? - Francesco Giancaterini, Alain Hecq, Claudio Morana

Investor Sentiment and Global Economic Conditions - Miguel C. Herculano, Eva Lutkebohmerẗ

A Factor-augmented Autoregression for Multilayer Networks - Matteo Barigozzi, Giuseppe Cavaliere, Graziano Moramarco

A Multivariate ARCH(∞) Model with Exogenous Variables and Dynamic Conditional Betas - Christian Francq, Julien Royer, Jean-Michel Zakoïan

Measuring Unobserved Judgment - Emilio Zanetti Chini